nassau county property tax rate 2021

Learn all about Nassau County real estate tax. It states the fair market assessed and taxable values.

10 Steps To Mastering The Art Of Real Estate Referrals Referral Marketing Real Estate Marketing Strategy Real Estate Marketing

Typically this means that people will pay an average of about 11232 per year just on their property taxes.

. 2021 Nassau County Municipal Tax Rates. The Nassau County sales tax rate is 425. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value.

If you are able please utilize our online application to file for homestead exemption. 86130 License Road Suite 3. Nassau County Property Appraiser.

Although taxable values have increased Countywide many property owners are protected by the Save our Homes SOH Amendment which caps the amount the assessed value can increase. March 01 2021 0342 PM. Cobra charges only 40 of the tax reduction secured through the assessment reduction.

Based on the CPI used for 2021 previously homesteaded properties will. Michael Hickox Nassau County Property Appraiser. Ad Get In-Depth Property Tax Data In Minutes.

This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales. More than 39000 homeowners will see increases of more than 3000 while 11000 will see increases of 5000 or more.

While the 2 percent figure is well above the 156 percent increase provided for in 2021 its good news for Nassau County homeowners already struggling with some of the highest property tax rates in the US. September 14 2021 0444 PM. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143.

Nassau County Tax Collector. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. It is also linked to the Countys Geographic Information System GIS to provide.

Tax Rate Per 1000 of Full Value City of Glen Cove. In Nassau County you can expect to pay an average of 224 of your homes assessed fair market value. The Nassau County sales tax rate is 425.

Find Nassau County Online Property Taxes Info From 2021. In Nassau you file with the Assessment Review Commission and the deadline is March 1 2021. The County Executive has proposed taking 100 million from Nassau Countys allocation of funds from the American Rescue Plan and distributing this money directly to residents.

Search Valuable Data On A Property. Whether you are presently living here just considering moving to Nassau County or planning on investing in its property study how district real estate taxes function. The tax reassessment affects 400000 residential and commercial properties in Nassau County.

One-time payments to. Some Nassau County property owners are a bit surprised at their tax bills this year following a countywide reassessment. The New York state sales tax rate is currently 4.

This is the total of state and county sales tax rates. Fernandina Beach FL 32034. Remember you can only file once per year.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. Ad Search Any Address in Nassau County Get A Detailed Property Report Quick. The amount of your 2021 STAR credit or STAR exemption may be less than the amount shown above due to either of the following reasons.

Suffolk County is a fraction more expensive clocking in at an average of 23 of the assessed fair market value. Homestead properties can increase no more than 3 or the consumer price index CPI whichever is lower. The deadline to file is March 1 2022.

Yearly median tax in Nassau County. How to Challenge Your Assessment. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

Assessment Challenge Forms Instructions. In Suffolk residents file with the town in which they reside and the deadline is May 18 2021. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made.

This is the total of state and county sales tax rates. These higher taxes reflect rising property values. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

Complete guide covering the Nassau County property tax rate county town village school taxes due dates Nassau County property search payments more. The New York state sales tax rate is currently 4. The Notice of Proposed Property Taxes TRIM Notice informs the owner of their proposed property values exemptions and millage rates for their upcoming tax bill.

You can pay in person at any of our locations. Nassau County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Such As Deeds Liens Property Tax More.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. City of Long Beach. Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Rules of Procedure PDF Information for Property Owners. If you have any questions his office can be reached at 904 491-7300. Nassau County Tax Lien Sale.

Your individual STAR credit or STAR exemption savings cannot exceed the amount of the school taxes you pay. The plan which will result in payments of up to 375 for qualifying residents has been approved by the Nassau County Legislature. Start Your Homeowner Search Today.

According to the county taxes will rise for 52 of homeowners and decline for 48. Explore how Nassau County applies its real estate taxes with this thorough review. When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000.

Laura Curran Getty Seven weeks ahead of election day Nassau County Executive Laura Curran is offering voters a.

Nassau County Ny Property Tax Search And Records Propertyshark

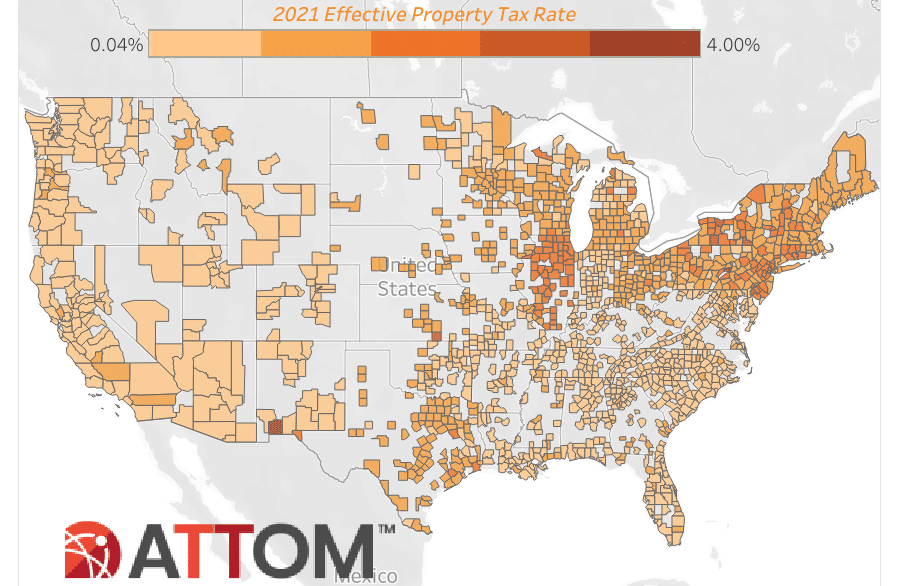

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Nassau County Ny Property Tax Search And Records Propertyshark

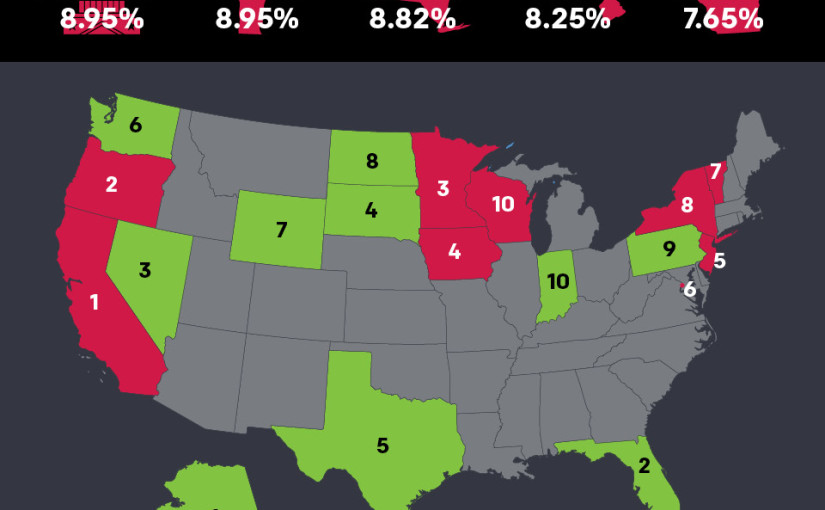

Lowest Highest Taxed States H R Block Blog

Tax Information Hempstead Town Ny

Long Island Property Tax Where Are We And How Did We Get Here Banking And Finance The Island Now

Suffolk County Ny Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Klingenstein Fields And Co Llc Rebrands As Klingenstein Fields Wealth Advisors Send2press Newswire Investment Advisor Investing Investment Portfolio

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-509182770-05842e74952a47d3adccf040641916cb.jpg)

Assessed Value Vs Market Value What S The Difference

Residents Pay The Lowest Property Taxes In These States

New York State Nys Property Tax H R Block

This Is The City With The Lowest Property Taxes In America Marketwatch

7 Ways To Create Tax Free Assets And Income

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

The Essential Guide To San Francisco S Steepest Streets San Francisco Streets San Francisco Francisco

Homebuyer Sentiment Sinks To A 10 Year Low Amid Tight Supply Yahoo Finance Refinance Mortgage Real Estate Salesperson Mortgage